The Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) program were two major financial relief initiatives created to help businesses survive the economic disruption caused by the COVID-19 pandemic. While both provided crucial support, they operated quite differently.

Paycheck Protection Program (PPP)

The PPP was established under the CARES Act in March 2020 and was designed as a forgivable loan program to help businesses keep employees on payroll during the pandemic shutdowns.

Key Features:

The loans were administered through private lenders (banks and credit unions) but backed by the Small Business Administration (SBA). The loan amount was calculated based on 2.5 times the average monthly payroll costs (later expanded to 3.5 times for certain businesses in the hospitality and food service industries). Eligible businesses could borrow up to $10 million.

Loan Forgiveness:

The distinctive feature of PPP was that the loans could be completely forgiven if the business used at least 60% of the funds for payroll costs within a specified period (initially 8 weeks, later extended to 24 weeks). The remaining 40% could be used for other eligible expenses like rent, utilities, and mortgage interest. If these conditions were met, the loan essentially became a grant—free money that didn’t need to be repaid.

Eligibility:

Small businesses with fewer than 500 employees, sole proprietors, independent contractors, and certain nonprofits qualified. The program went through multiple rounds of funding, with adjustments made to address early problems with access and equity.

Economic Injury Disaster Loan (EIDL)

The EIDL program actually predated COVID-19—it’s a longstanding SBA program traditionally used for natural disasters. It was dramatically expanded and modified during the pandemic to provide broader relief.

Key Features:

Unlike PPP, EIDL loans were provided directly by the SBA, not through private lenders. Businesses could borrow up to $2 million (initially lower, then increased). The loans had very favorable terms: 3.75% interest for businesses (2.75% for nonprofits), 30-year repayment terms, and an automatic deferment period before payments began.

EIDL Advance:

Early in the pandemic, applicants could request an advance of up to $10,000 (later adjusted to $1,000 per employee up to $10,000) that didn’t need to be repaid, essentially functioning as a grant. This provided immediate cash flow relief while the full loan application was processed.

Purpose:

EIDL was broader than PPP—it could be used for any working capital and operating expenses, not specifically tied to payroll. This made it useful for covering a wider range of business expenses during economic hardship.

Key Differences

Forgiveness: PPP loans could be entirely forgiven; EIDL loans generally had to be repaid (except for the advance portion).

Administration: PPP went through private lenders; EIDL came directly from the SBA.

Use of Funds: PPP was heavily focused on payroll; EIDL was for general business expenses.

Speed and Access: PPP processing varied by lender but could be faster; EIDL applications often faced significant processing delays due to overwhelming demand.

Controversies and Challenges

Both programs faced significant criticism and growing pains:

Access Issues: In early rounds, many small businesses struggled to access PPP loans while larger companies with established banking relationships received funding quickly. This led to revisions prioritizing underserved communities.

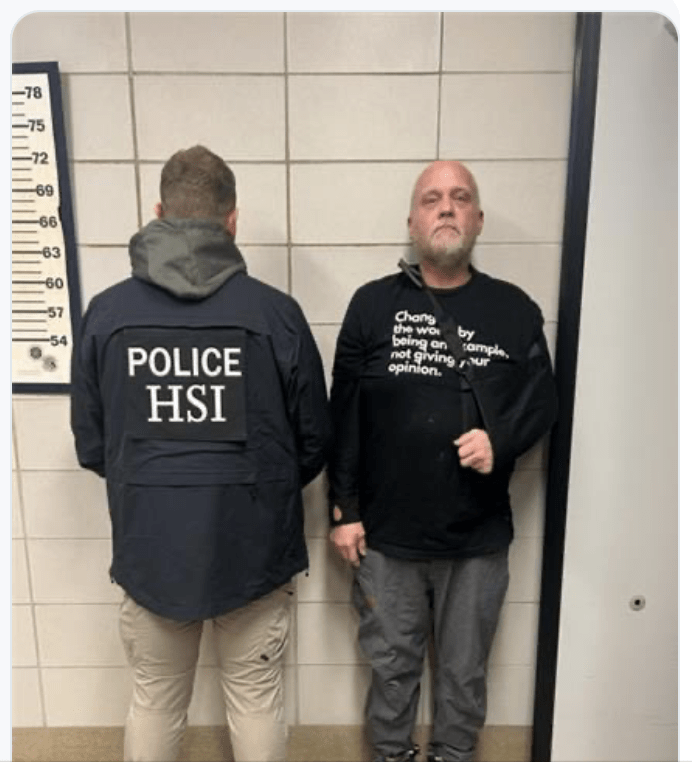

Fraud Concerns: The speed of the programs and relatively loose initial oversight led to substantial fraud, with some recipients using funds inappropriately or fraudulently claiming eligibility. The government has since pursued numerous criminal cases.

Forgiveness Complexity: The PPP forgiveness process was confusing for many borrowers, with changing rules and extensive documentation requirements, though it was eventually simplified for smaller loans.

Large Recipients: Public outcry occurred when large, publicly traded companies received PPP loans, leading many to return the funds and rule changes to prevent similar situations.

Processing Delays: EIDL faced massive backlogs, with some businesses waiting months for processing while facing immediate financial crises.

Long-term Impact

Both programs distributed hundreds of billions of dollars and are credited with preventing massive business closures and job losses during the worst of the pandemic. The PPP alone provided over $790 billion in forgivable loans. However, economic analyses continue to debate their efficiency—some studies suggest the programs saved millions of jobs, while others argue the costs per job saved were extraordinarily high and that significant funds went to businesses that wouldn’t have failed anyway.

The programs officially ended in 2021, though EIDL loan repayments continue and will for decades. The experience has influenced discussions about how government should respond to future economic crises and what safeguards are needed when distributing emergency relief at scale.

Leave a comment